Does Insurance Cover Auto Glass in California?

Is Windshield Replacement Covered by Insurance in California?

Auto glass damage is a common issue for drivers, whether caused by rocks, hail, vandalism, or accidents. When your windshield or windows are damaged, the big question is: Will my insurance cover the costs? If you're a California resident, understanding how your auto insurance interacts with glass repairs or replacements can save you money and reduce stress. This article delves into auto glass coverage in California, including what policies typically cover, the types of glass repairs, and tips for navigating your insurance claim.

Does Auto Glass Insurance Coverage Vary?

In California, auto insurance policies differ widely depending on providers and the coverage options you choose. Most standard policies usually include some form of coverage for auto glass damage, but the specifics can vary:

- Comprehensive Coverage: This is the most relevant for auto glass repairs. It generally covers damage caused by non-collision events, such as vandalism or theft, as well as natural events, such as hurricanes.

- Liability Coverage: Unlike comprehensive, liability insurance does not cover glass repairs. It only covers damage to other vehicles or property if you're at fault.

- Collision Coverage: While primarily for accidents involving hitting another vehicle or object, collision coverage can also cover windshield damage resulting from a collision.

It’s essential to check your policy details or speak with your insurance agent to confirm whether your plan includes auto glass coverage.

How Auto Glass Claims Work in California

When your auto glass gets damaged, the process for filing a claim typically involves the following steps:

- Assessment of Damage: Have a professional evaluate whether the damage is repairable or requires a complete windshield replacement. Many auto glass shops do this for free.

- Filing a Claim: Contact your insurance provider to report the damage. Be prepared to provide details about the incident and any documentation or photos of the damage.

- Deductible Considerations: Most insurance policies require you to pay a deductible—the amount you're responsible for before coverage kicks in. In California, there’s no set average deductible for auto glass claims, as it varies based on your specific policy. Depending on your coverage—especially if you have full glass protection—your deductible could range from $0 up to $500.

- Choosing a Repair Shop: Some insurers have preferred vendors, while others let you choose your own. California law mandates that auto glass shops must use industry-approved adhesives and comply with safety standards.

- Reimbursement and Payment: Once the repair is complete, your insurer will either pay the shop directly or reimburse you, depending on your policy.

Does Insurance Cover All Types of Auto Glass?

Most insurance policies in California cover common auto glass issues, including:

- Windshields

- Side windows

- Rear windows

However, some less common types of glass damage might not be covered, such as:

- Custom or specialty glass

- Damage resulting from neglect or pre-existing issues

- Cracks that are smaller and can be repaired rather than replaced

It's advisable to verify the specifics of your coverage with your insurer before proceeding.

Benefits of California’s Zero Deductible Glass Coverage

In Florida, drivers can opt for zero-deductible glass coverage, but in California, the benefits depend on your policy. Some providers offer optional coverage that eliminates or reduces out-of-pocket costs, especially for windshield repairs, which are usually less expensive than replacements.

Advantages include:

- Reduced or no costs for repairs

- Quick repairs to maintain visibility and safety

- No impact on your deductible if covered

Always review your policy and speak with your insurance agent about available options.

Tips for Navigating Auto Glass Insurance Claims in California

Navigating insurance claims can be complex, but these tips can help:

- Document everything: Take clear photos of the damage before and after repair.

- Use authorized shops: Choose shops approved by your insurer for smoother processing.

- Understand your policy: Be aware of your deductible, coverage limits, and exclusions.

- Keep records: Save all receipts, correspondence, and related paperwork for the claim.

- Check for roadside or emergency assistance: Some policies offer free or discounted services for urgent repairs.

Understanding your insurance policy, knowing how to file a claim, and choosing the right repair shop can simplify the process and keep you safe on the road.

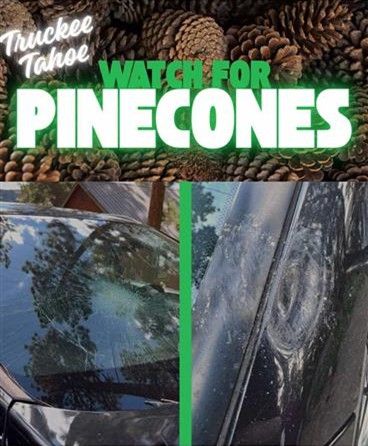

Do You Have Auto Glass Damage in the Sierra Foothills?

If you have

auto glass damage in

Truckee,

Grass Valley, or

Colfax, CA,

contact us at Sierra Mobile Glass. One of our technicians can get to you quickly with our mobile service, or you can visit us in-shop—we’ll get your vehicle back on the road in no time.

Click here for a free quote!